When we approach the market, we tend to look at technical analysis or fundamental analysis, and based on our assumptions about what we are reading, we’ll take a trade. But there’s a special series of questions that should occur before any trade we take: a series of questions that will deliver an edge, says Anne-Marie Baiynd of TheTradingBook.com.

And what every trader needs to consistently win is an edge—an edge that gives us the upper hand in our chosen time frame for our trade. So, ask yourself honestly, do I have an edge? Most of us cannot answer this question with confidence. I’m going to reveal the straightforward approach that many high-performance traders like me use every day when we enter the market.

We ask the following questions about the market—looking at a weekly chart—what is the near-term trend and the overall trend?

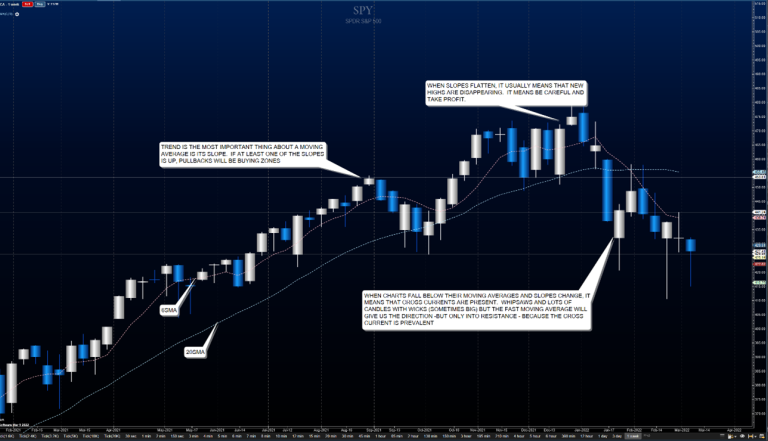

To answer this, I use a 6sma and I consider the near-term slope. And I do the same thing with a 20 sma? I ask myself while looking at a weekly chart—am I above an upward-trending moving average on a 6sma? Am I below a downward trending moving average on a 6sma?

Am I above an upward-trending moving average on a 20sma? Am I below a downward-trending moving average on a 20sma?

If the answers are yes for both the 6sma and the 20sma—either both moving up or both moving down—I have trend on my side.

The next question I ask myself—if I take the trade in the direction that matches the trend, what is the risk associated with taking the trade?

To answer this question, I look for support areas that are congested and/or tested; or for resistance areas that are congested and/or tested?

Knowing the answers to these questions will tell you definitively if the trade is going to hold in your favor or against it.